Switching to Cloud Accounting Software

Switching to Cloud Accounting Software — Your Complete Migration Guide

More firms are now switching to cloud accounting software. Here’s the list of benefits, why to make the move and how to make it successful.

Accounting processes are undergoing a substantial shift — according to recent survey data,

“67 percent of accountants now say that cloud technologies can help make their roles easier, and 51 percent believe that having the technological skills to effectively use these technologies will have a significant impact on their careers in the next 5 to 10 years”

The result? More firms are switching to cloud accounting software as a way to make the most of their existing resources and financial data — but effectively making the switch requires a combination of solutions and skills to ensure organizations can make the most of cloud-based accounting options.

In our guide to cloud account migration we’ll consider some of the key drivers behind this shift, unpack key benefits, provide suggestions for making the switch and offer advice on ensuring optimal integration.

Why Consider Switching to Cloud Accounting Software?

Simply put, the sheer volume and variety of data now generated and processed by accounting departments outstrips the ability of most legacy and on-premise offerings.

Here’s why: Not only are accounting teams dealing with traditional transactional data, they’re also dealing with a host of new information around historic spending habits and proactive cost reduction along with the expectation of digital first, on-demand accounts payable (AP) and invoicing services that don’t keep clients and customers waiting.

Cloud-based accounting software offers a way for companies to shift the bulk of their efforts off local stacks and into provider-managed resources that scale on demand.

Combined with advanced analytics and reporting tools, cloud accounting software makes it possible for teams to focus on the business side of financial operations rather than getting bogged down in the details.

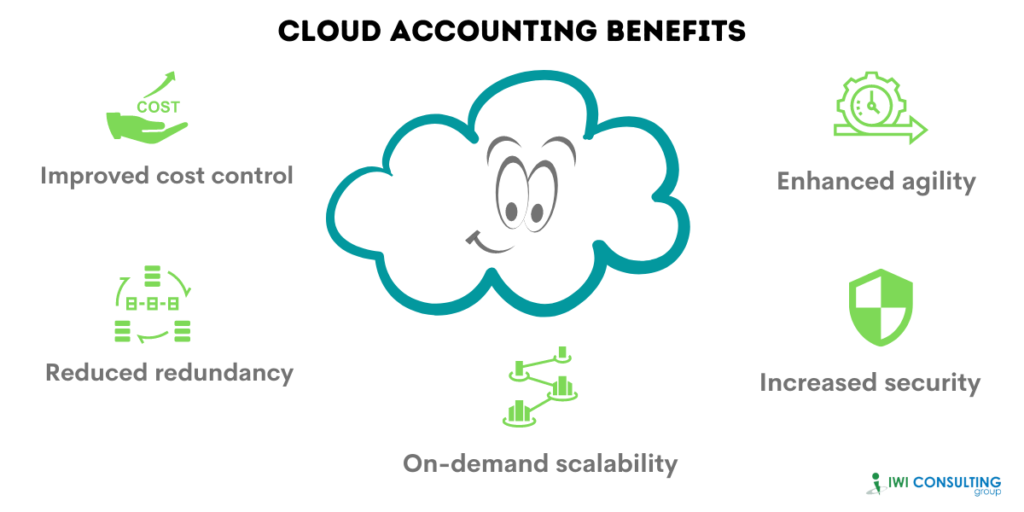

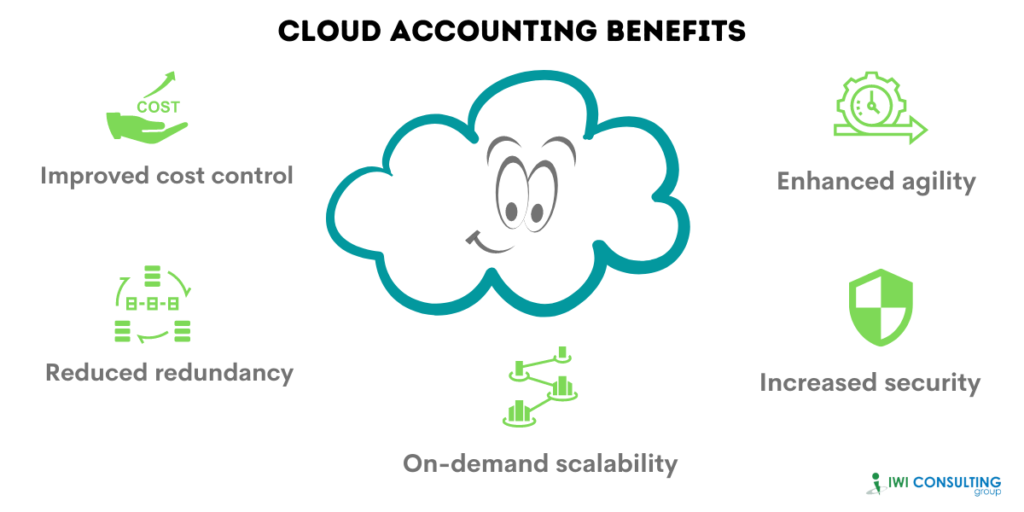

Unpacking Key Cloud Accounting Benefits

According to a 2017 research paper published on International Journal of trend in Scientific Research and Development (IJTSRD) cloud Accounting has more benefits.

“According to a new survey of 506 accounting and finance professionals commissioned by FloQast and conducted by Dimensional Research, 79 percent of accountants are using at least one cloud-based financial application“

– FloQast

Cloud accounting software offers key benefits, including:

Improved cost control

Granular control over the scope of services used makes it easier to ensure budgetary targets are met. For example, using the Sage Intacct solution, professional employer organization (PEO) Optimum employee solutions was able to eliminate 50 hours per month in manual accounting work to reduce total spend.

Reduced redundancy

With cloud-based systems, data entered is automatically populated and shared with all employees who have access, in turn reducing process redundancy. Education non-profit FARES leveraged cloud accounting to improve efficiency by 30 percent.

Enhanced agility

Cloud software can be accessed anytime, anywhere, making it easier for accounting staff to complete key tasks. Recent survey data found that companies automating more than 50 percent of their journal entries can close their books 20 percent faster.

On-demand scalability

The cloud is scalable by nature, which means companies can quickly add or reduce compute capacity as needed.

Increased security

Cloud providers have made significant investments into security solutions that empower robust data encryption and obfuscation to frustrate attacker efforts; 94 percent of companies said they saw improvements in security after moving to the cloud.

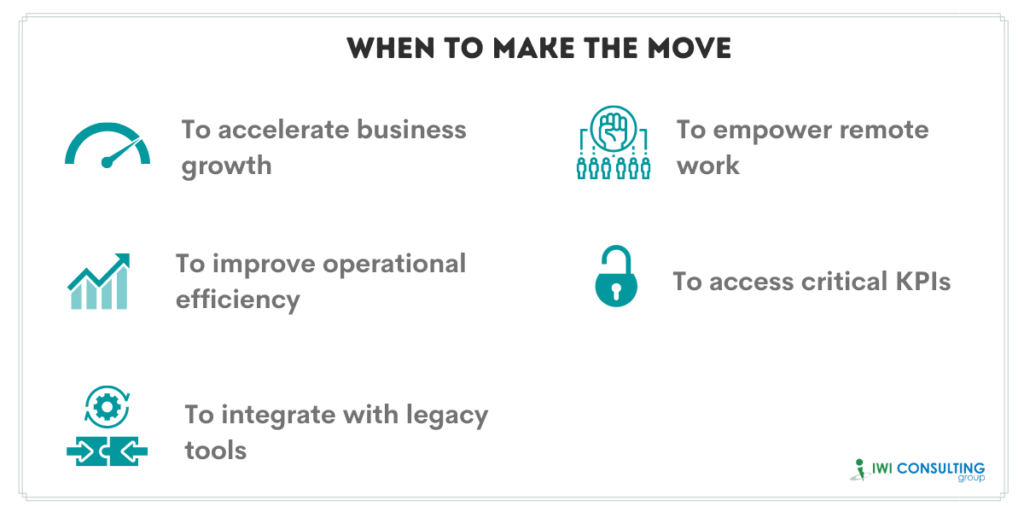

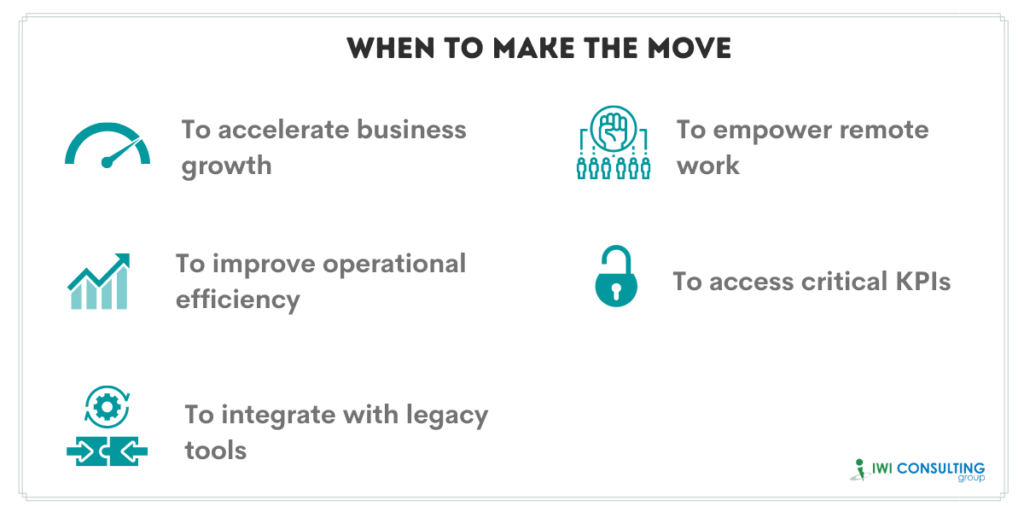

Considerations When Making the Move

Before making the move to cloud solutions, it’s worth taking time to identify specific needs. Here’s why: While cloud-based software can help address all manner of accounting challenges, simply adopting these solutions isn’t enough to capitalize on their potential. Instead, companies are best-served by identifying their immediate needs and deploying solutions that align with these necessary functions.

Some of the most common include:

The need to accelerate business growth

If your company is on the cusp of substantive business growth, it may be worth deploying cloud solutions as a way to expand functionality without expanding total headcount while growth is underway.

The need to empower remote work

With remote and hybrid work now par for the course and expected to remain even after pandemic pressures subside, cloud solutions offer an ideal way to close the gap between in-office and in-house productivity.

The need to integrate with legacy tools

Many companies still leverage legacy tools for specific functions. If these tools are capable of even moderate cloud integration, you may be able to save the cost of expensive custom coding.

The need to access critical KPIs

Key performance indicators can help guide business operations; cloud solutions provide a way for firms to access self-serve, on-demand KPIs.

The need to improve operational efficiency

Desktop and departmental silos remain a common problem for organizations. Cloud solutions avoid this issue by providing collaborative and continual access.

Making the Switch from Other Accounting Solutions to Sage Accounting Solutions

Some of the most compelling cases for the switch to Sage Accounting Solutions are the hidden costs and complications associated with many limited cloud accounting solutions and on-premise solutions.

Consider the popular financial solution QuickBooks, which is still used by businesses worldwide to manage their accounting practices. While the tool is well-established and comes with a host of familiar features, many companies have found that over time the drawbacks outweigh the benefits.

| “In the five years since we graduated to Sage Intacct, our revenue increased significantly, and there’s no way we could’ve kept up with that growth if we were still using QuickBooks. I used to work up to 80 hours a week, but now I work 40-hour weeks with the same-sized team, thanks to the amazing automation and productivity boost we gained with Sage Intacct” Business Manager, Berkshire Associates |

Four areas are often causes for concern:

Manual processes

Manual processes are par for the course with QuickBooks — and for one company, the errors caused by these processes led to $180,000 of improper expense reimbursement over a six-month period.

Data importing

Importing data into QuickBooks from other accounting tools is both time- and resource-intensive and often drives significant productivity loss.

Software failures

As data volumes increase, on-site deployments of QuickBooks often struggle to keep up. In one case, the result was a crash that caused accounting data loss for 350 hourly employees.

Calculation errors

Lacking the built-in ability to manage complex accounting processes, many companies will create additional processes that run in parallel to QuickBooks. The result? Potential calculation errors based on placeholder or stale data that leads to reduced ROI.

Making the switch to cloud-based software makes it possible to both avoid these hidden costs and access a new level of data transparency that helps drive better outcomes.

From Startup to SMB’s and enterprise solutions, Sage Business Cloud has flexible and innovative accounting solutions to manage your money, people, payroll, payments, projects & more.

Sage Intacct cloud accounting software, meanwhile, is the only software approved as a preferred financial management solution by AICPA.

Creating a Plan for Optimal Integration

When it comes to making the move, companies are often best-served by creating plans that help optimize and streamline integration.

This starts with a recognition of potential pitfalls — for example, shifting software might be challenging during the middle of the fiscal year, and some legacy tools may not interact well with new cloud-based solutions.

As a result, any plan for integration should address five key areas:

Speed of deployment

The faster you can deploy and integrate cloud software, the better. IWI Group offers 20-day fast start implementation of Sage cloud accounting software to help you get up and running ASAP.

Availability of features

Accounting is a continuously-evolving field — as a result, new features and functions are necessary to keep pace. To meet these expectations, the Sage cloud is continuously evolving to provide optimal business value.

Reliability of service

Robust and reliable cloud services ensure that resources and data are always available when you need them. As a result, it’s worth looking for providers that offer substantive and specific cloud commitments.

Scope of support

Support shouldn’t stop when deployment is complete. Ongoing support from IWI Group helps ensure you’re always getting the most from your cloud accounting software.

Visibility of data

Improved visibility drives improved accounting outcomes. The Sage Intacct and Sage 300 Cloud offers end-to-end data visibility to help companies make informed decisions on-demand.

Bottom line? Switching to cloud accounting software can help enhance payroll and AP processes, streamline operations and improve overall cost control.

Ready to get started? See how IWI Consulting Group can help.

Contributed By: